My family likes to catch up on public holidays.

Because Covid restricts the number of people in a home, it has been an interesting experience knowing my extended relatives a bit more personally.

One particular day, my Uncle asked me how I felt about Endowus, and investing his CPF-OA with them. This surprised me.

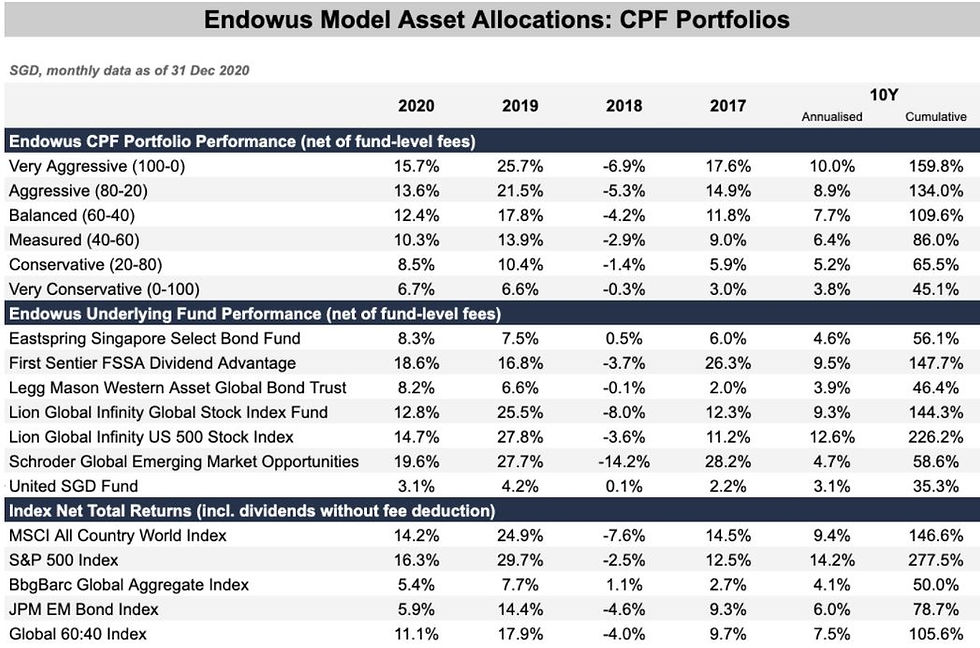

I was looking at some reports on the Endowus website in July about their year end performance, after looking at how my own investments performed through my ILP with my Investment Advisor.

For myself, I don't really like the fact that Endowus is claiming to have a track record even though they've not been in the Singapore market that long. Yes you can do backtesting but even Stashaway which was arguably Singapore's most popular robo-advisor for a very long time, did not suggest that kind of track record while being transparent about most of their holdings. If my Financial Consultant can be reported anonymously for 'misleading consumers' just because he presents backtested data while providing disclaimers, Endowus should experience far worse. That aside, I brought it up with him and asked him whether my Uncle should invest his CPF-OA. As usual, his eyes lit up greedily and he began to confirm specific things:

a) Has his RA been fully met yet? b) Any large outstanding liabilities?

c) Any investment experience? Ideas about the portfolio?

I gave him some answers, but the only definitive that I remembered was that my Uncle had already met his FRS/RA account back when he was 55, and he had quite a bit of excess monies in his OA account.

Usual Issues with Investing CPF-OA instead of Cash

1) History of Issues

The ST editor, Tan Ooi Boon sure seems to think its a huge problem investing CPF-OA. Of course, CPFIS does have a history of limited investments, fees - to the point that even a limit on stocks and gold had to be imposed.

You can read some of this if you're looking for a reason not to invest your CPF - but I think his credibility is diminished somewhat because the cumulative data is much better than just taking the one year return alone, but he only featured the one year return in his article. (journalists.)

Besides, once you account for the people who are super determined to use CPF-OA to invest in something like hedging tools like precious metals instead of money making stocks, these numbers are a lot better than one might think.

2) The Investment Range isn't as good

a) Lower Risk Funds: Lots of Bonds and Mixed Asset Allocation Funds. To me, this isn't good because you already have a risk premium of 2.5%. If the returns aren't good, you may as well leave it in CPF. b) Broader or Geographical Funds: You can still have exposure to one country like China, but they do tend to be made out of Blue chips more, or have much lower volatility than some cash China funds. One of the Original Money Maverick's drafts demonstrates this, when a China Fund with a higher tech concentration did much better against another China fund: but they both had the same benchmark. I'll likely edit and publish that when I can (buying and sorting through 60 drafts is not easy at all) Not all actively managed funds are the same, and I think while MAS has probably done a reasonably good job making sure riskier funds aren't accessible using CPF - there's also the missed opportunities.

c) Single Sector Funds: I haven't found a CPFIS fund that gives me exposure to something like a sub-sector (e.g. semiconductors only) and I can't buy ARKK with my CPFIS. The furthest I've seen is large-cap/blue chip tech, so I guess that's about as much risk as we can be allowed to take using CPF-OA.

In summary, I often see much higher potential results for cash investments (thanks to the range of investments available) than CPF-OA, despite the high fees.

3) Potential Conflict of Interest for Fees

a) Prior to the MOM Market cap on CPFIS, investing with your CPFIS has had a long history of conflict of interest with potentially high sales charges.

One particular extreme story I heard was how someone who desperately wants to convert their CPF to cash could buy a product from an agent, who would then pay them back some or all of the cash from the commission paid out to them.

I have no evidence that ever happened and it sounds desperate for liquidity...but it certainly SOUNDS like something that might reasonably happen.

This has been weeded out more so with cash recently, where some of my inside sources have told me that we will likely see a decline of sales charges or bid-offer for ILPs and other products.

When Should You Invest Your CPF After 55?

I've seen what kind of track record my investment advisor has with cash investments and when I purchased the blog, his available CPF investment options. At one point in May, my $10,000 with him had become $24,000 in a little more than a year. Another investment with him went from $12,000 to over $45,000.

So I don't often disagree with him in this arena, when he's made me more money than any non-leveraged, low cost index fund available has made in the last 4 years, net of fees. But my profile desires extremely high returns.

This simply isn't true for others, especially older people.

So if you, or more likely your parents: are above 55, when should they invest their CPF? [in my opinion]

1) When Their RA is Hit Already: I think FRS is a really good safety net and would rather contribute to it to meet the full requirement if I had not done that before 55. 2) If They're Willing to Risk the CPF-OA for Higher Returns: Obviously this is the only reason why anyone should invest at all. This is even more pronounced when CPF gives you so much 'free' interest. In my opinion, I wouldn't invest for a duration shorter than 10 years and I wouldn't aim for less than 6% net of fees, if I am using my CPF-OA already giving me 2.5%. It just wouldn't be worth it to me otherwise.

3) If Their Investment Range and Risk is Within CPFIS: As mentioned, there are usually a lot less available CPFIS funds than cash funds. But the thing about this is that while there would be potentially high opportunity cost from not being able to invest more aggressively before 55, that opportunity cost is usually greatly reduced after 55, at least from my limited understanding.

I don't know a lot of people who want to take the same risks at me at 55, and even me at 55 would likely not want to take the same risks as me now. READ ALSO: Why CPFIS Failed Before (and why it wont fail now)

Why Should You Invest Your CPF-OA after 55?

While CPFIS isn't under your CPF nomination, what's important to me is that your CPF savings are protected from creditor claims.

It would look more plausible on paper to have CPFIS sold back into my CPF account as opposed to trying to duck my debts by contributing to my CPF.

...I'm still exploring this, like any reasonable Maverick would.

2) Lower Fees:

We know that CPFIS fees have dropped only so recently (as recent as 2020) and this really opens up potential for people who had completely written off using their CPF-OA to invest in the past. Since MOM made it more favorable: unless I am wildly interested in pursuing a broader diversity of investments or higher returns net of fees, the probability of someone over 55 being charged lower fees is higher if I use CPF-OA compared to cash.

Closing Thoughts:

I did eventually tell my Uncle my thoughts, but I let him speak to my investment advisor, who he decided to work with in the end. After all, it is always better to speak to a professional before any major decisions. Still, I do think that there's going to be others who might share my opinion. If you intend to invest after 55 anyway, you could invest through CPFIS instead of taking it out as cash to invest. You would likely have lower fees and then it could always be sold back into OA account for 2.5%.

In any case, if you disagreed or have some thoughts about my opinion, why not leave a comment here? And if you thought it made sense, you can always reach out to us as well. We'd be happy to refer you to a consultant with integrity (or you can just reach him directly at the link below).

Till next time,

Money Maverick

Original Draft by the Original Money Maverick [Jan 2021]: 'Analyzing Endowus' Results and the Limitations of CPF Investments' Written by Seth

Edited by Tina

留言