Can My Bank Empty My Account For My Housing Loan? Featuring the 'Backdating Property' Fraud Case

- Money Maverick

- Oct 13, 2021

- 7 min read

Updated: Feb 7, 2023

Our mum didn't hit her first career break until about 8 or 9 years back. I didn't understand a lot at the time, but Mum had a new name card and a big smile on her face.

According to some statistics, over 70% of lottery winners not only lose everything they made, but some of them even end up declaring bankruptcy.

For Mum, 'winning the lottery' was when she secured a decent job after the completion of her advanced Diploma? (truth be told, I'm still not sure what upskill this was). She moved to an even better job 2 years after that: going from making just above $3500 almost all her life to about $9000.

Just like the fairytales, our lives increased in quality overnight.

One of the ideas proposed to her at the time was to upgrade our existing HDB to 2 private condominiums.

Towards Mum, I can't be too critical. Back when she decided to commit fully to sending Tina and me to University [both of us would eventually need additional funds for Private since we failed local requirements].

But she also became exceedingly vulnerable to financial suggestions. It got really out of control, until we met my Financial and Investment Advisor - the original writer of this blog - 4 years ago and saved us quite a lot of money - which I'll be writing about in my upcoming article: "How, When and Why: Professional Replacements Of Insurance Policies and Saving Over $40,000".

Just as every end to a fairytale, as you close the book and get back to reality. Mum did not get two condominiums as she dreamed. We did upgrade, and years later, we still have a controlled outstanding mortgage left just below 6 figures.

Through the ups and downs, we've come awfully close several times to defaulting and my Mum is already in her early 50s. It's frustrating.

The point of that long story is that property has become a noticeably sensitive issue to me. When I bought my property under a year ago, I was much more careful because of how many considerations, unfavorable black and whites, and hidden 'fees' were required.

So the news of buyers who avoided taxes unfairly to get sentenced was very satisfying.

For those of you who were not satisfied with just the outcome alone, perhaps you will be more satisfied after this article.

After speaking to my Financial Advisor, he pointed out some fun things which I hadn't even noticed in the loan I'm currently paying for. Some of these extracts are an example from the DBS Mortgage Loan Terms and Conditions (2020) I've looked at the 2021 contract and it isn't too different.

With that, it's time to answer the article title: Question: Can my bank empty my account for my housing loan? Answer: If your housing loan is from the same bank as your bank accounts - its a hell yes.

Financial Consequence:

According to the Right of Set-Off, the bank reserves the right at ANY TIME, with NO NOTICE to combine or contribute your accounts and liabilities and use it to wipe your debts with the bank clean.

There's even currently some cases ongoing where the debt is being pursued towards the owner of the JOINT account and not the guarantor.

Which means if I, the guarantor, owned a 'DBS' joint bank account with my mum and served as the guarantor for a 'DBS' loan that went horribly wrong, some T and Cs could suggest that the bank could and would pursue my mum for this loan after I declared bankruptcy.

(I'll find the case study later).

Note that realistically while signing on this dotted line would mean that they pretty much guarantee a win in any court unless your lawyer is a miracle worker, the PR damage would be much worse than winning any lawsuit...IF it were grossly unfair.

I'm hopeful that everyone who's ever loaned money to a friend that they never got back might be completely objective about this, though - rather than simply sympathetic.

Some Considerations: I usually dislike over-diversification but you may want to keep your bank accounts and your bank loan separate.

Question: Can my Bank Force me to pay back my Loan anytime they want? Answer: Pretty much.

Financial Consequence:

According to the events of default, under 21.1.18 - if the bank has the opinion that the security of the loan given to you is compromised, they reserve the right to demand the entirety of the loan back. And if you can't afford that, they'll take the collateral (your house).

I'm not sure about what 'Going to Jail' falls under but I'm guessing its not 'Confidence' and probably more like 'Jeopardy'.

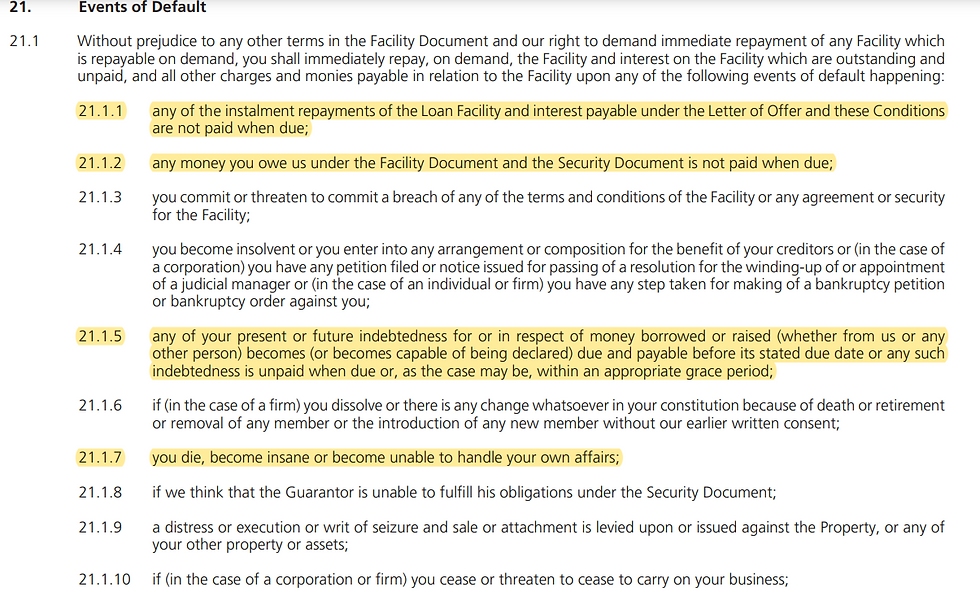

Some of the other ones are even more outrageous. Most of us are familiar with 21.1.1, which is the one we are most agreeable to (probably the fairest one) but literally in 21.1.8 the bank just literally says 'if we THINK the Guarantor can't do it'.

Considerations:

I already mentioned that banks would strike a balance between pursuing loans and PR, but you should probably have your Critical Illness Insurance done up as well.

Yes, what a Segway that was.

I topped up my Critical Illness cover with Term Insurance after I took on the additional expenditure of my new home (which I have to service with cash).

Why? Because most safety nets such as HPS (Housing Protection Scheme) do not cover in the event of Critical Illness. It was also not mentioned during my Decreasing Term Insurance offer.

Based on the conditions, if I get a critical illness (e.g. a stroke, or WORSE, a coma) I might incur the wrath of the following: 21.1.7 You die, become insane or become unable to handle your own affairs

21.1.8 If we think that the Guarantor is unable to fulfill his obligations under the Security Document

21.1.10 If (in the case of a corporation or firm) you cease or threaten to cease to carry on your business

21.1.14 An event occurs or circumstances arise which gives us reasonable grounds to believe that you may not be able to perform or comply with any of your obligations under any Facility Document or any Security Document

21.1.18 If in our opinion, any security given to us in relation to the Facility, or (if you are a corporation or firm) your business, is in jeopardy

You get it. Naturally, it was my Financial Consultant who pointed out and helped me address this risk.

Some Critical Illness incapacitate you, so you should probably have your LPA done up as well. I actively refer my Investment Consultant as much as possible, but he didn't write one of these so here's one from Pang Zhe Liang.

Some Final Takeaways

1) Don't put off Important Purchases:

It's quite unlikely the entire case study would never have happened if the couple had managed to settle their property on time.

Similar to Insurance or Investments, time is of the essence. Insurance is cheaper when you're younger and healthier, while Investing early allows compound interest to do significant work if you have your monies in the market.

2) Greed Is Good, Except When It's Bad

It is reasonable to want to look for solutions to get the highest value for the least amount of money. That's why there are so many comparison sites around.

But there is a difference taking part in legal loopholes versus illegal activities, or Tax avoidance vs Tax Evasion. Tax Avoidance is perfectly legal, but not a lot of people have a good public opinion about it and tend to sneer their nose at people who do it.

For example, Donald Trump paid next to nothing in taxes while Obama paid significantly more. It's fairly obvious who the world likes more (Obama), and additional icing on the cake is that Donald likely took advantage of his predecessors policies to do so as an additional slap to the face - but to someone who understands why Greed is Good, I'm in awe of the one who legally didn't have to pay taxes. (and Mavericks should be too)

Comparatively, there's a huge difference between doing that and commiting a clear crime (Tax Evasion) like a fool. Everyone went to jail and no one is financially better off for it.

3) Professional Service Doesn't Always Equate To Highest Benefits for the Client

One of the key things that struck me a lot was that the court determined that the couple had instigated both

i) The proposal to backdate the option

ii) They would only proceed with the transaction if it were done

If we give the Property Agent the benefit of the doubt, this would create the highest financial value for the client...if the illegal act wasn't caught.

We often tend to place a lot of blame on the middlemen like Real Estate and Insurance Agents, but you imagine what it feels like to be in that scenario where your weeks or months of work could dwindle down to nothing because the client was unreasonable in this way. Worse, the client was unreasonable AFTER they were responsible for causing the fiasco in the first place - if they had decided earlier in the ample time they had, none of this would have been occurred. That doesn't excuse criminal activity or bad decision making in the slightest, but:

1) People have to understand that Clients are more often than not, the principal villains in such stories

2) Middlemen have to understand that professional service doesn't = being a lapdog.

If you're looking for a Financial Advisor with integrity, you can always let me know and I'd be happy to refer you.

Have you had a nasty experience with your bank loan? Why not share your experience or thoughts on this article in the links or comments below?

Money Maverick

Links provided above.

Original Draft (written 2020):

How Unreasonable are Loan Terms and Conditions Actually? 3 Things You Need to Know - By the Original Money Maverick

Edited by Tina

This article raises crucial questions about the security of our assets when repaying housing loans. The backdating property fraud case serves as a reminder to thoroughly understand loan agreements and protect our finances. It's a wake-up call to stay informed and proactive in safeguarding our assets.

What an eye opening article! The backdating property fraud case underline the need for vigilance in financial transactions. It's alarming that banks could potentially empty accounts to cover loans, even in fraud cases. This serve as a reminder for everyone to understand loan agreements thoroughly and stay alert against potential abuse of power. Great job!